The Power of Probabilistic Cash Flow Analysis

It is obvious to say that credible financial forecasting plays a pivotal role in decision-making within project management. One of the most effective ways to achieve this is with an analysis technique known as probabilistic cash flow (PCF).

Safran Risk software is renowned for its comprehensive project risk analysis capabilities and offers a PCF toolset which is a tangible enabler. In this blog post, we will introduce the world of PCF analysis and explore how Safran Risk can render a traditional deterministic cashflow analysis virtually obsolete.

Understanding Probabilistic Cash Flow Analysis

Traditional cash flow analysis typically involves estimating costs and revenues based on deterministic assumptions, static unchanging elements like:

| a) Cost per Unit | - How much? |

| b) Quantity of units | - How many? |

| c) Planned Timing of Expenditure | - Starting when? |

| d) Planned Duration of Expenditure | - Spending until? |

These elements can reveal peaks, troughs, as well as average daily / weekly / monthly / quarterly / annual expenditures. This information is critical for CAPEX owners and or operators, enabling them to govern available funds to meet anticipated demand.

It is vital to be aware that this approach does not cover or capture the inherent uncertainties and risks associated with projects, such as:

- Market Forces & Availability (External Price Fluctuations)

- Incomplete Surveys & Design (Uncertain Scope)

- Undecided Methodology (Optioneering & Stakeholder Satisficing)

- Delays in Preceding Activities (Schedule Uncertainty & Dependencies)

- Activity Duration Uncertainty (Inherent Planning/Perception vs. Reality)

- Failed Mitigation Initiatives (Internal Controls Fail)

Note: Elements A, B, C and D are intrinsically energised, movable and unpredictable until ‘after-the-fact’ when they become known quantities.

This is where PCF Analysis can assist a Cost Engineer, Quantity Surveyor (QS) or Project Manager (PM) identify probable scenarios that can be tested to determine how the project simulation behaves, and also how one feels in seeing those scenarios play out?

How can one best respond in real-life to an unusual (or undesirable) cashflow situation?

vs.

How should one respond if that scenario were to arise?

Strategically, one can work-through a roleplay scenario with the project team, or equally with strategic partners, collaborators, stakeholders, and even clients to ensure that one can present discoveries with recommendations.

Points to remember:

- How should we collectively best respond to the various scenarios?

- What is the win-win scenario?

- Are some of these scenarios definitely off-limits? (as we may assume they are?)

OR - Would there be any "wiggle-room" should such a scenario arise?

- One option could be to reprofile. To resequence the work such that the cashflow never spikes above this amount in any month, quarter, or year.

- However it may delay the project completion by X many days

- What scenario is most preferable?

- However it may delay the project completion by X many days

How does Probabilistic Cashflow Work in Safran Risk?

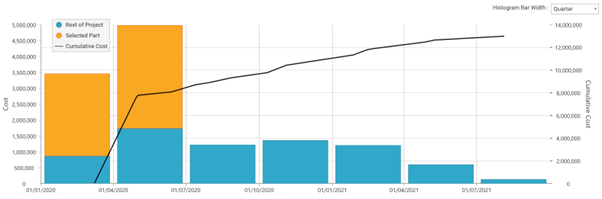

By applying Monte-Carlo Simulation to a logic-linked schedule, that is either already resource-loaded, or mapped to a Cost Breakdown Structure (CBS), it is possible to render the static cashflow and then stress test it against all variables discussed above.

Note: The data may be imported from MS-Excel

Probability Distributions are then used to randomly sample the outcomes of each variable. Each iteration enables you to build up a picture of a possible reality (outcome), that can be quickly compared to thousands of others. A rich multiverse is waiting for you to explore.

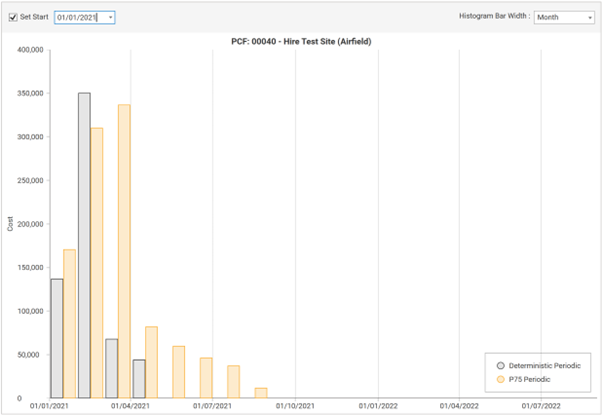

The image above shows that in 75% of simulated iterations:

- You can expect to see a higher cost expenditure than planned for almost every month,

- That you can expect to be on this worksite for 4 months longer than originally planned,

- That you’re not expecting to arrive at this site and start spending money before January 2021

- That you shouldn’t anticipate spending more than the client’s $350k funding ceiling (phew – finally some good news!)

How else can Safran Risk help you test your deterministic Project Cashflow hypothesis?

- Change the Simulation Inputs! Ask “What-If x?” – See how the outputs change and save them into Safran’s comparison database to help articulate your findings later.

- Sensitivity Analysis by Exclusion reveals the relative contribution of each input variable (as duration and/or cost – not statistical jargon), giving sensible hotspots to prioritise for further mitigation potential.

- Prolongation Calculations and Contractual Delay-Penalties can also be automatically included into the outputs, which will be of varying importance to different stakeholders and prompt some useful discussion to avoid nasty surprises later.

- Report images can all be exported, along with raw simulation data for maximum flexibility.

Conclusion

Your projects contain complexities, nuance and interplay between project financing, contractual constraints, and the realities of schedule logic versus hopes and promises made.

Probabilistic Cash Flow analysis is an invaluable tool for project managers seeking to credibly forecast cost scenarios.

Furthermore, Safran Risk not only helps project managers make better-informed decisions, manage risks proactively, and communicate financial implications to stakeholders with clarity, Safran Risk enables you to apply PCF functionality to reveal potentially nasty surprises and thereby take action to reduce shocks.

When supported by your colleagues, in a collaborative working style, Safran Risk help you to take your projects to new levels of success.