The professional project management arena is very dynamic, and your choice of Risk Modeling tool can make or break your strategies. It's not just about functionality; it's about finding a tool that seamlessly integrates with your workflow, empowers customization, and delivers top-notch performance.

Enter Safran Risk! My name is Rami Salem, and in my view Safran Risk stands out among Risk Modeling tools. This software application offers a blend of an intuitive user interface, robust features, and unparalleled performance.

Having explored various tools in the past, I can confidently say that Safran Risk surpasses them all.

Let's dive into the five most captivating features of Safran Risk that are revolutionizing the way we manage risks.

1. Integrating Cost and Schedule Risk Models

In other Project Risk Model tools I find that well-integrated Cost and Schedule Risk Models are lacking. They treat Cost and Schedule as two separate Risk Models.

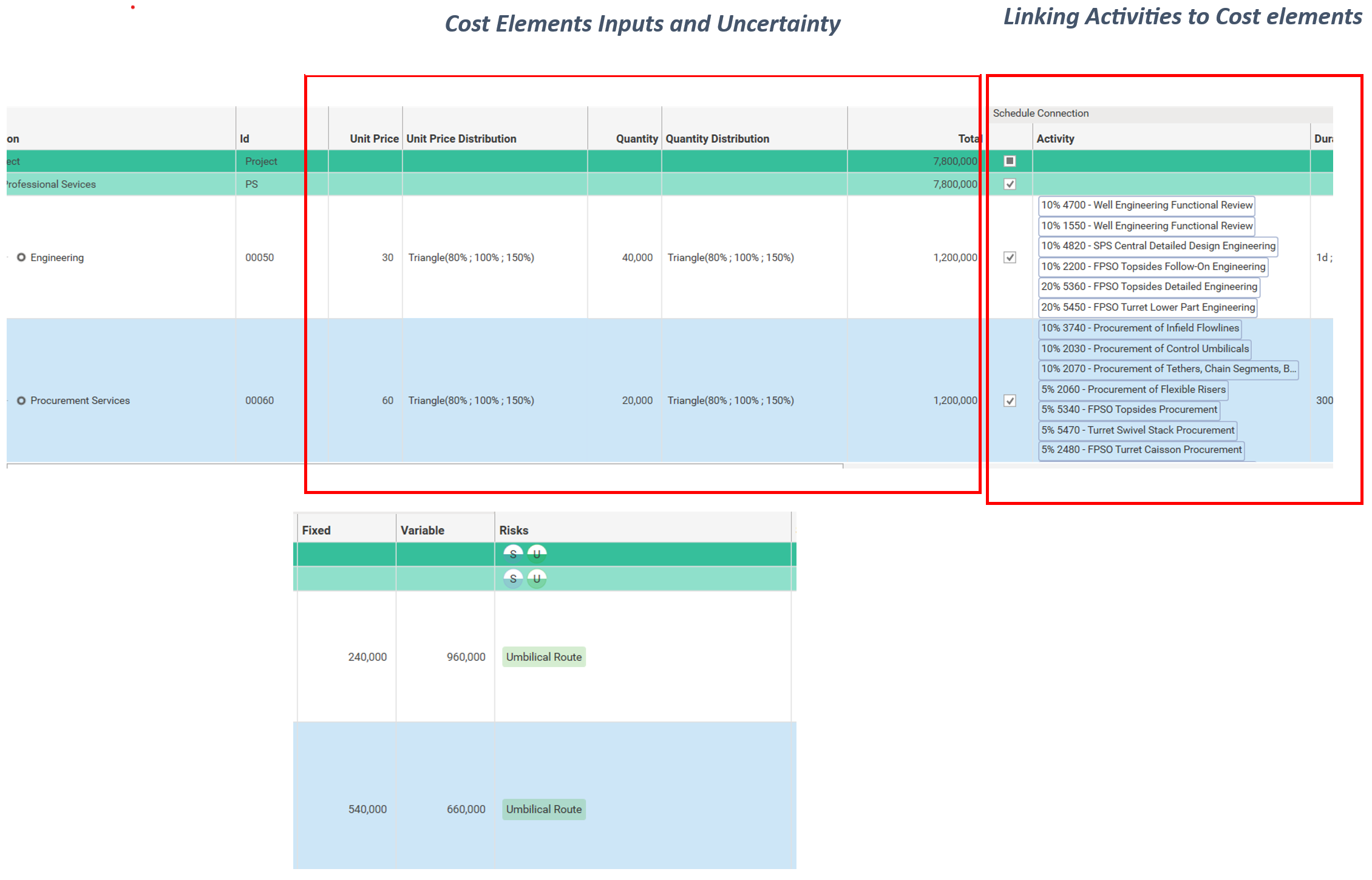

However within Safran Risk, the Cost and Schedule Risk models are integrated in a powerful way that means cost elements are linked to activity duration, and will therefore be affected by the shortening or lengthening of the duration within the Risk Model. It is possible to map several activities to a cost element, thereby determining how the activities contribute to total cost. In addition, you can model the uncertainties related to the Unit Prices or the Quantity which is essential for most, if not all, capital projects.

NOTE: You can define the Fixed Costs and the Variable Costs and Assign Risks related to these cost elements.

2. Global Risks

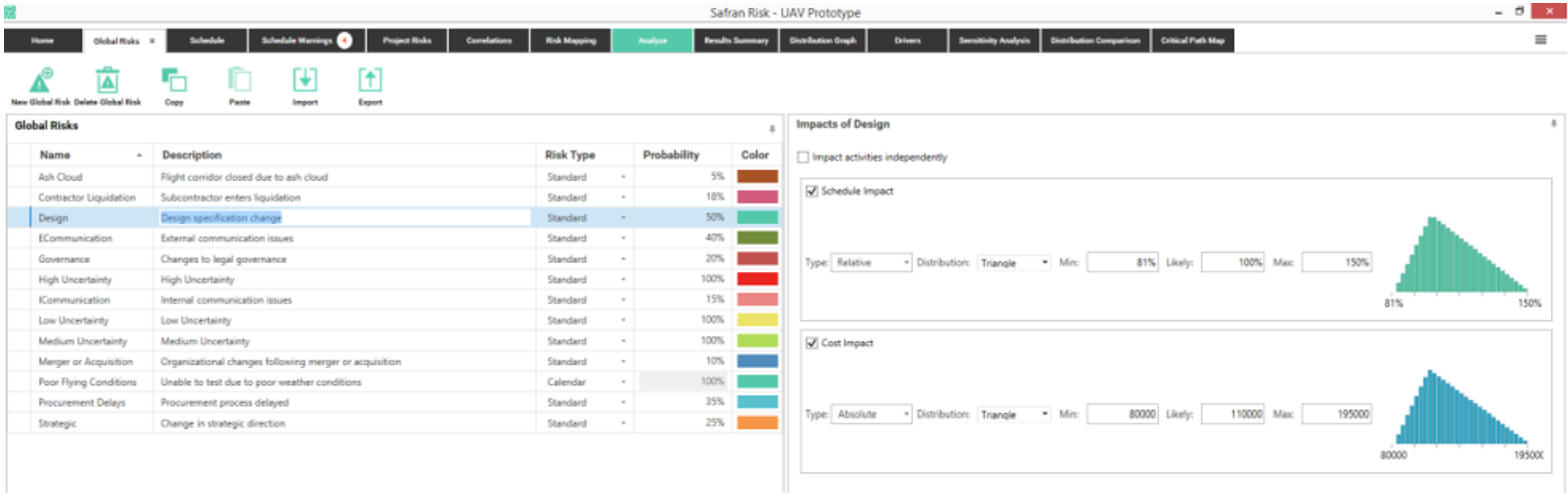

If you are a Risk Manager, then you are aware of how much time is lost when having to enter the same Risks into each Risk Model for your different Projects.

Ah ha! But with Safran Risk, I am able to define Global Risks! This feature was a significant time saver, and powerfully enabled me to place all common risks in the same place. I may easily add a common risk from the Global Risk Register to my Project Risk Register at the click of a button.

3. Joint Confidence Level (JCL)

Ever wondered whether the P80 for Schedule is the same P80 for Cost?

No! they are not the same, and if you are using a typical Risk Modeling tool you would have to calculate a P80 Cost separately from the the P80 Schedule. Only then could you combine the two.

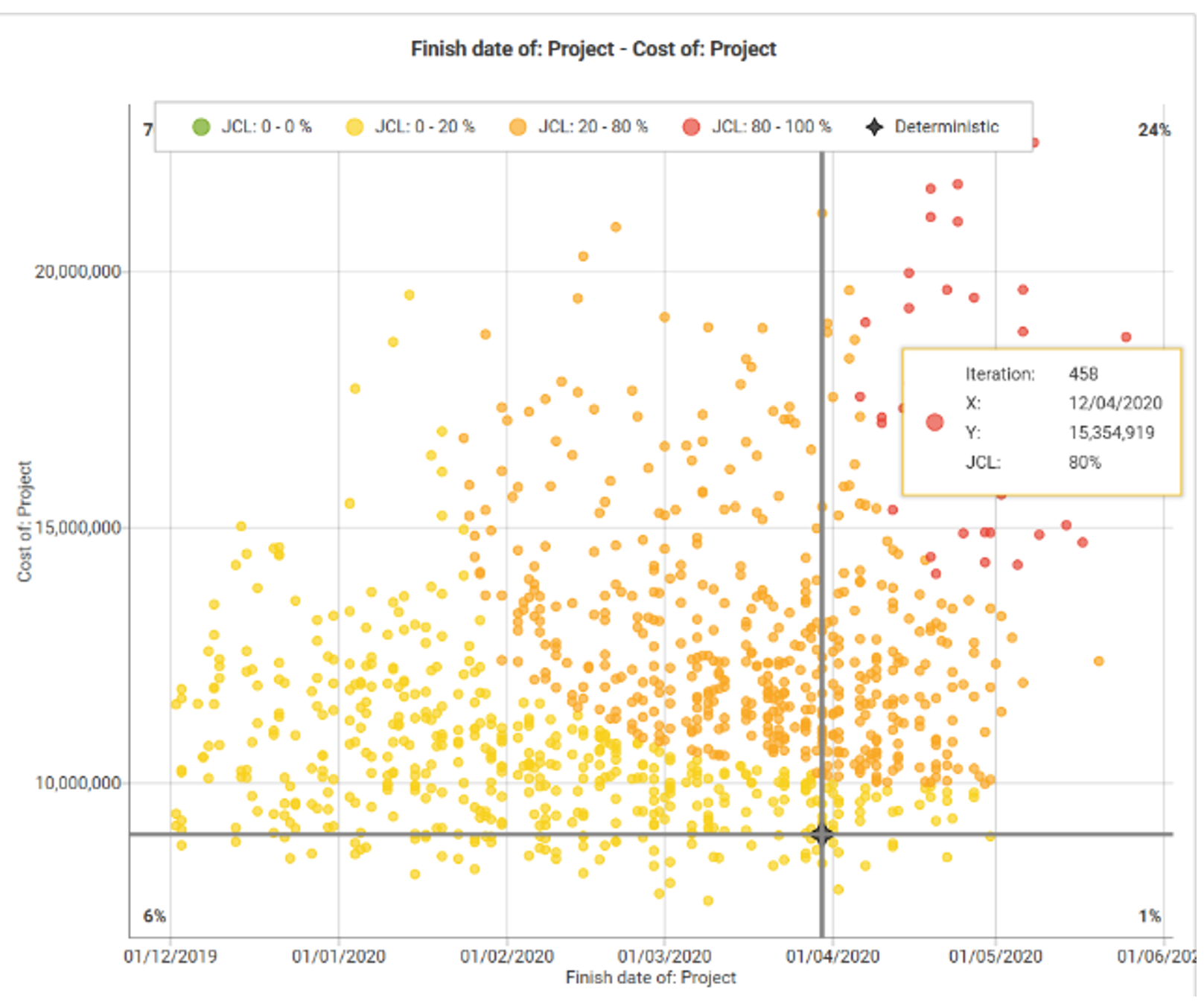

Safran Risk provides a Joint Confidence Level (JCL) feature, where you can combine Cost and Schedule confidence levels simultaneously for these points. Thus you can reach a P80 point for both Cost and Schedule at the same time without hassle.

This dual-focused analysis is essential for stakeholders to understand the full scope of potential risks and make balanced decisions. Clearly, JCL is a vital tool for comprehensive Project Risk Analysis. The Graphic below is a Scatter Plot highlighting the P80 for JCL points.

Watch this 3 minute JCL explainer video

4. Sensitivity Analysis by Exclusion

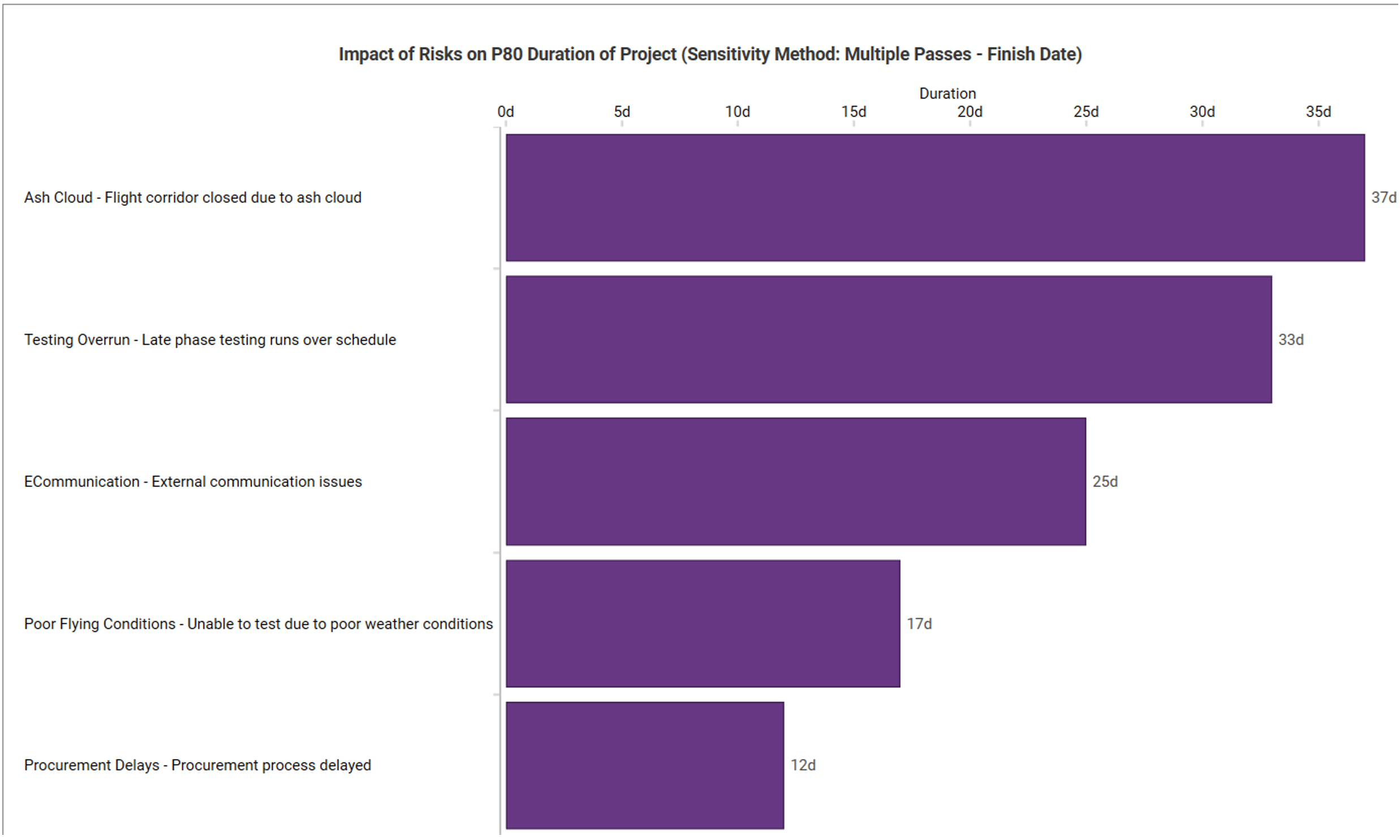

We know that QSRA stresses the deterministic critical path that drives a project's durations/finish dates. Different iterations of a risk analysis will reveal alternative ‘near-critical pathways’ depending on the severity of impact and the presence of float (to shock-absorb risk impacts) on an iteration-by-iteration basis of the Monte-Carlo Simulation.

For this reason, Sensitivity Analysis by Exclusion can be carried out to show which risks consistently have the highest possible impact on a project’s duration, regardless which pathway is being adopted.

Safran Risk automates the process of re-running the simulation multiple times, so you don't have to. Once completed, Safran Risk provides a tornado that can be re-rendered instantly as you casually navigate the model, whereas other risk analysis software with a similar feature either,

- Re-calculates its equivalent tornado diagram each time you click on another part of the schedule or cost model which takes extra compute time, or,

- Just provides a tornado ranking risks and activities on traditional correlation co-efficient, Schedule Sensitivity Indexes etc which are of more limited value compared to the absolute real-world values provided by Safran’s Sensitivity Analysis by Exclusion method. (That being said, you can still use traditional sensitivity tornados if you want to).

5. Weather Modeling

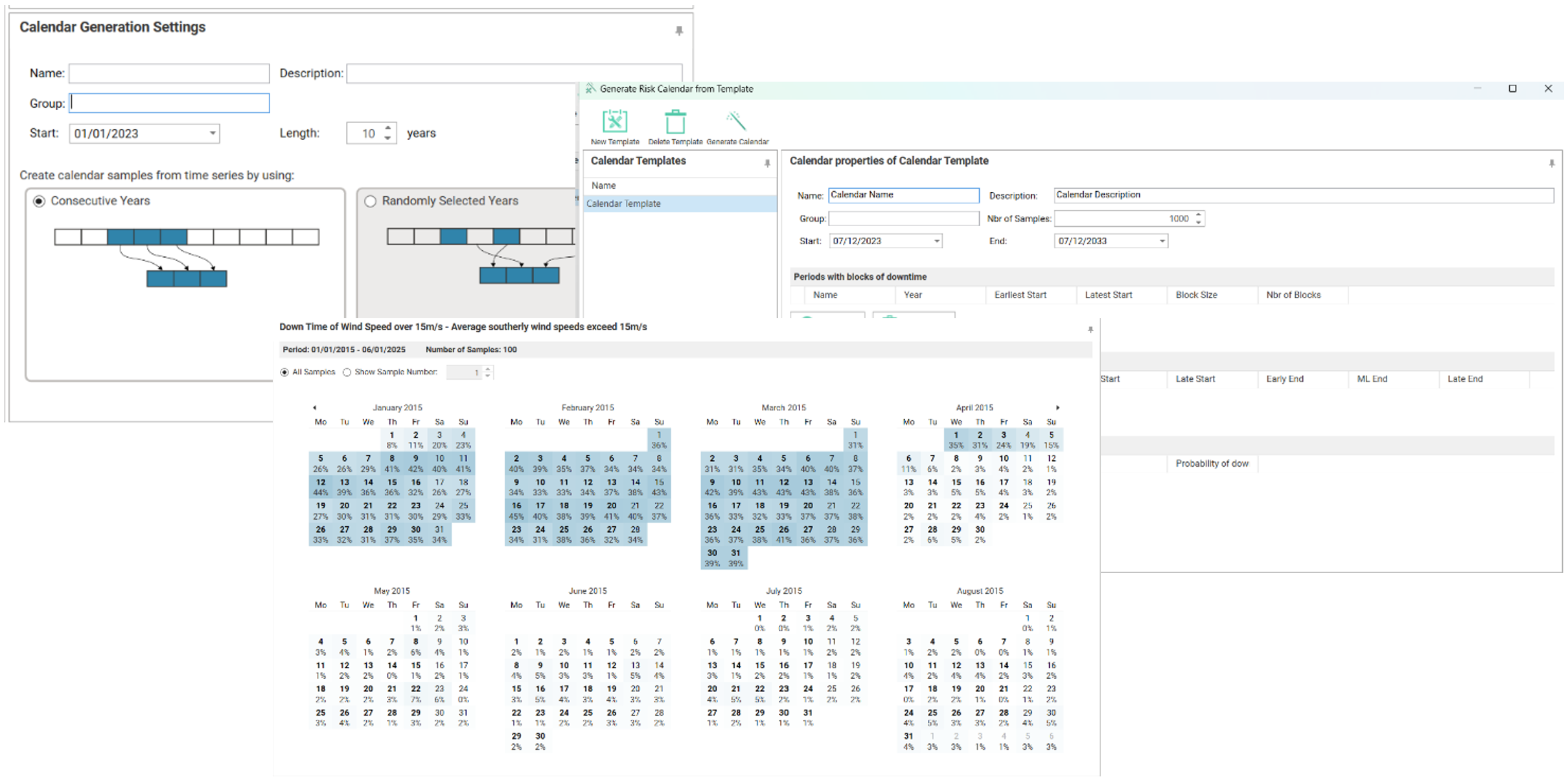

Lastly, I want to focus on Weather Modeling within Safran Risk. This feature is much more advanced than in other tools. I found that I was able to generate Weather Modeling from historical time series and in relation to the project location.

I discovered that I could achieve a more accurate picture of the anticipated weather conditions and impacts for a project. In addition, I was able to create a block period of 'down time'. As shown in the captured image below, I was able to block a date range with probabilistic down time. The versatility of options provides different methods that help to model weather conditions within the risk model according to the project context.

You can also apply different Risk Calendar scenarios to the Pre and Post mitigated positions, as well as handling more than 1 Risk Calendar at the same time (this caters for different scenarios, which might not be 'weather' related).

6. My Conclusions:

It is important to know that I have only highlighted a few of the powerful features within Safran Risk. In my view, the most fascinating and enabling feature is the integrated Cost and Schedule capability within Safran Risk, since it is incredibly powerful and easy to use. No hassle!

As an experienced Risk Management Consultant, I have found that the area of cost and schedule risk always carries the majority of a project's complexity.

The combination of the other features mentioned: Global Risks, Joint Confidence Levels (JCL), Multiple Path Sensitivity Analysis and Weather Modeling makes Safran Risk my software of choice when it comes to Risk Modeling for projects.

If you want to contact me directly, please email: Rami Salem

Or connect with me on Linkedin: My LinkedIn Profile